One of the most important things to have when traveling is travel insurance. However, travelers who are planning a trip often overlook this insurance. How To Get The Best Travel Insurance Plans will guide you on how to get the best travel insurance.

Why should you have travel insurance?

Travel insurance is a type of insurance policy that protects you financially against unexpected events that may occur while you are traveling. There are numerous reasons why having travel insurance is essential, some of which are as follows:

Medical Emergencies: You may require medical attention if you become ill or injured while traveling. Medical treatment, hospitalization, and emergency medical evacuation can all be covered by travel insurance.

Trip Cancellation or Interruption: Unexpected events such as a family emergency, natural disaster, or airline strike may force you to cancel or shorten your trip. Travel insurance can assist you in recouping non-refundable expenses.

Luggage Lost or Stolen: Losing or having your luggage stolen can be a frustrating and stressful experience, especially if you are in a foreign country. Travel insurance can reimburse you for lost, stolen, or damaged luggage.

Travel Delays: Delays in travel, such as flight cancellations or missed connections, can disrupt your plans and result in additional costs. While you wait for your next flight, travel insurance can cover the costs of hotel accommodations, meals, and transportation.

Personal Liability: If you inadvertently damage someone’s property or injure someone while traveling, travel insurance can provide liability coverage to protect you from financial responsibility. This is the next element in How To Get The Best Travel Insurance Plans.

What you need when buying travel insurance

When purchasing travel insurance, it is critical to consider your personal needs as well as the type of trip you are taking. Here are some things to think about and keep in mind:

Make certain that your travel insurance covers the country or countries you will be visiting. Some policies have geographical restrictions, and specific types of coverage may be required in certain countries.

Coverage Limits: Examine the policy’s coverage limits. Check that the limits are appropriate for the type of trip you’re taking and the activities you’ll be participating in.

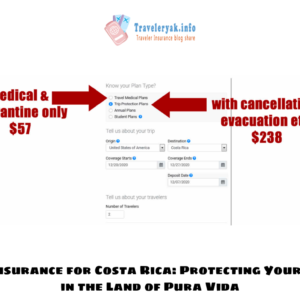

Medical Coverage: Examine the policy’s medical coverage. Look for a policy that includes emergency medical treatment, hospitalization, and evacuation.

Pre-Existing Conditions: Check to see if your policy covers any pre-existing medical conditions. Some policies may not cover pre-existing conditions, while others may charge higher premiums.

Trip Cancellation Coverage: If you’re worried about a trip being canceled or interrupted, make sure the policy covers these scenarios. Check the policy for covered cancellation reasons and the amount of coverage available.

Travel Delay Coverage: If you’re concerned about travel delays, make sure your policy covers the costs of missed flights or other modes of transportation.

Coverage for Lost, Stolen, or Damaged Baggage and Personal Belongings: Check the policy for coverage for lost, stolen, or damaged baggage and personal belongings.

Emergency Assistance: Ensure that the policy includes 24-hour emergency assistance in the event of an emergency while traveling.

Price: Compare the cost and coverage of various policies to find the best one for your needs and budget.

To summarize, before purchasing travel insurance, review the policy’s coverage and limitations to ensure that it meets your specific needs and the type of trip you’re taking. This is the next element in How To Get The Best Travel Insurance Plans.

How To Get The Best Travel Insurance Plans

Choosing the best travel insurance plan is dependent on several factors. Here are some tips to help you find the best travel insurance plan for your needs:

Determine your travel requirements: Before you begin looking for travel insurance, consider your travel requirements. Do you require protection against trip cancellations, medical emergencies, or lost luggage? Once you’ve determined your requirements, you can begin looking for plans that provide the coverage you require.

Shop around: Don’t settle for the first travel insurance plan you come across. Shop around and compare various plans from various providers. Look for plans that provide the coverage you require at a reasonable cost.

Read the small print: Make sure you thoroughly read the policy details. Examine the policy for any exclusions or limitations. If you have any questions, contact your insurance company and request clarification.

Check the insurance provider’s reputation: Before purchasing a plan, check the insurance provider’s reputation. Look for other travelers’ reviews and ratings. Select an insurance company that has a good reputation for customer service and claim handling.

Consider the price: Travel insurance costs vary greatly depending on the coverage you require, your destination, and the length of your trip. Compare the prices of various plans and select one that provides good value for money.

Think about your medical history: If you have a pre-existing medical condition, make sure your travel insurance policy covers it. Some insurance companies may refuse to cover certain conditions or charge a premium for coverage.

Check for additional advantages: Some travel insurance policies include extra benefits like coverage for adventure activities or rental car insurance. If you need these benefits, look for plans that offer them.

By following these steps, you can find the best travel insurance plan for your needs and travel with peace of mind. This is the next element in How To Get The Best Travel Insurance Plans.

Conclusion

Preparing travel insurance for every trip is essential because you will not know how risky your trip is. Hope the article How To Get The Best Travel Insurance Plans will provide useful information for you.