Travel is one of life’s great pleasures, but even the most carefully planned trip can be derailed by unforeseen circumstances. That’s where trip cancellation coverage comes in. But what exactly is it, and how does it work? In this article, traveleryak.info will explore the basics of trip cancellation coverage, including what it is, how it’s typically offered, and what you can expect from a typical policy.

What is Trip Cancellation Coverage?

At its most basic level, trip cancellation coverage is a type of travel insurance that provides reimbursement for pre-paid, non-refundable expenses if you need to cancel your trip unexpectedly for a covered reason. Covered reasons typically include things like illness or injury, death of a family member, severe weather, or other unforeseen events that make it impossible to take your trip as planned.

- Illness or injury that prevents you from traveling

- Death or serious illness of a family member

- Natural disasters or severe weather that impact your travel plans

- Job loss or unforeseen work obligations

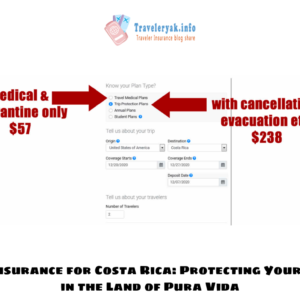

There are two main ways to get trip cancellation coverage: as part of a comprehensive travel insurance plan or as optional coverage to a base travel insurance policy. Premium travel credit cards like the Chase Sapphire Reserve® may also offer trip cancellation coverage as a benefit [1]. Some travel insurance companies even sell trip cancellation as a standalone policy [2]. It’s essential to carefully review the policy to understand what is and isn’t covered.

How is Trip Cancellation Coverage Offered?

Trip cancellation coverage is an important aspect of travel insurance that can provide peace of mind for travelers. This coverage can help protect against unforeseen circumstances such as illness, injury, or unexpected events that may force a traveler to cancel or interrupt their trip.

There are different ways that trip cancellation coverage can be offered to travelers. One way is through a comprehensive travel insurance plan, which can include a range of coverage options such as trip cancellation, trip interruption, medical expenses, and more. These plans are typically offered by insurance companies and can be purchased either directly from the insurer or through a travel agency.

Another way that trip cancellation coverage can be offered is through premium travel credit cards. Some credit cards offer this benefit as a perk for cardholders who use the card to book their travel arrangements. For example, the Chase Sapphire Reserve® card includes trip cancellation and interruption coverage up to $10,000 per person and $20,000 per trip.

The cost of trip cancellation coverage can vary depending on the type of plan or card selected. For a basic travel insurance policy that includes trip cancellation coverage, travelers can expect to pay between 5% and 10% of their total trip costs. However, the cost can increase for more comprehensive plans that include additional coverage options.

It’s important for travelers to carefully review the terms and conditions of any trip cancellation coverage they are considering. Some policies may have specific exclusions or limitations that may affect coverage, such as pre-existing medical conditions or certain types of activities.

In summary, trip cancellation coverage can be offered as part of a comprehensive travel insurance plan or as a benefit on premium travel credit cards. The cost of coverage can vary, and travelers should carefully review the terms and conditions of any policy or card they are considering. By doing so, travelers can help protect themselves against unforeseen circumstances and enjoy their trip with greater peace of mind.

The Benefits of Trip Cancellation Coverage

Having trip cancellation coverage provides peace of mind when planning your trip. Life is unpredictable, and unforeseen events can happen. Knowing that you have financial protection in case of cancellation can help you avoid financial losses.

In addition to trip cancellation, travel insurance plans may also offer other benefits such as:

- Trip interruption coverage, which reimburses you for expenses if you need to end your trip early for a covered reason

- Emergency medical and dental coverage, which can provide financial protection if you get sick or injured while traveling

- Lost or stolen baggage coverage, which reimburses you for lost or stolen luggage or personal items

By having a comprehensive travel insurance plan that includes trip cancellation coverage, you can enjoy your trip with peace of mind.

In conclusion, trip cancellation coverage is an essential travel insurance benefit that can provide financial protection if you need to cancel your trip unexpectedly for a covered reason. By carefully reviewing your travel insurance policy, you can ensure that you have the coverage you need to enjoy your trip with confidence.