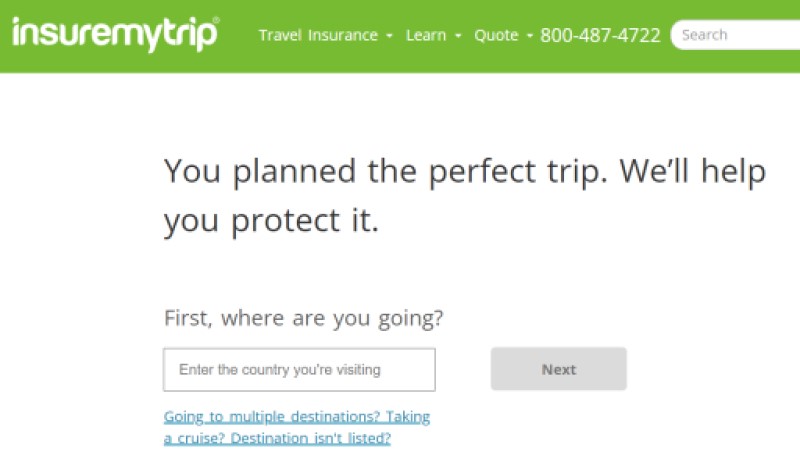

If you’re planning a trip this year, there are a few things you should do to ensure you have the best travel insurance possible. InsureMyTrip is a great resource for finding the right policy for you and can help you save money on your coverage. Let’s find out with traveleryak!

About InsureMyTrip

InsureMyTrip is a travel insurance comparison website that allows you to compare and purchase travel insurance plans from different providers. Founded in 2000, InsureMyTrip has helped millions of travelers find the right travel insurance coverage for their needs.

InsureMyTrip offers a wide range of travel insurance options, including trip cancellation, emergency medical coverage, baggage protection, and more. By comparing plans from different providers, you can find the coverage that best fits your travel needs and budget.

The website also offers a variety of helpful resources and tools, including customer reviews, travel insurance guides, and a 24/7 customer service team to answer any questions you may have. Whether you’re planning a quick weekend getaway or a long-term international trip, InsureMyTrip can help you find the right travel insurance coverage to protect your trip and give you peace of mind.

The benefits of using InsureMyTrip

Comparison shopping: InsureMyTrip allows you to compare travel insurance plans from different providers, so you can find the coverage that best fits your needs and budget.

Customizable coverage: InsureMyTrip offers a variety of travel insurance options, including trip cancellation, emergency medical coverage, and more. You can customize your coverage to include only the features you need.

Access to customer reviews: InsureMyTrip features customer reviews and ratings for each plan, which can help you make an informed decision about which plan to choose.

24/7 customer service: InsureMyTrip has a dedicated customer service team that is available 24/7 to answer any questions you may have about travel insurance.

Free quote comparison: InsureMyTrip offers a free quote comparison tool, which allows you to see side-by-side comparisons of different plans and prices.

Peace of mind: Travel insurance can provide peace of mind by protecting you against unexpected events, such as trip cancellations, medical emergencies, and lost or stolen baggage.

InsureMyTrip’s travel insurance plans

Travelers can use InsureMyTrip to discover the best travel insurance policy for their upcoming trip. They provide a huge selection of options from the best providers of travel insurance. Comprehensive, trip health insurance, emergency evacuation, Schengen visa, and accidental death are the six main categories under which the plans can be divided. Each sort of plan offers a different set of advantages.

1. Comprehensive

Of all the plan kinds, comprehensive travel insurance offers the most advantages. For the investment you have made in your trip, these plans offer the greatest protection. Since they can be used for both leisure and work travel, they are the best option for almost all travelers.

The majority of all-inclusive plans also include trip interruption, baggage, medical, dentistry, emergency evacuation, 24-hour traveler assistance, and accidental death benefits in addition to trip cancellation coverage. These advantages are very typical of complete travel insurance policies, though they can differ from plan to plan.

2. Medical

Plans for travel medical insurance provide the precise, defined coverage that some people require when traveling overseas. Only travelers leaving their home country who require medical insurance to fill in the gaps in their main health insurance coverage while traveling abroad are eligible for these plans. As a result, we strongly advise getting in touch with your insurance agent or health insurance provider to find out how much medical coverage you will have while traveling overseas.

3. Evacuation

Plans for emergency medical evacuation offer transportation assistance if you get severely ill or hurt while traveling. If the assistance provider and the doctor believe you’d be better off at another facility, these plans typically offer emergency medical evacuation to the closest facility that can provide adequate care.

You might be able to specify the facility to which you want to be taken if you have an emergency medical evacuation plan. This benefit, referred to as “hospital of choice,” varies in availability depending on the plan. This benefit may be included in some programs, may be added to others, or may not be offered at all. The majority of plans also handle the return of mortal remains.

4. Schengen Visa

Travelers who need a Schengen Passport to enter one of the 26 European countries that make up the Schengen Area can purchase travel insurance specifically designed for them. Citizenship, not residency, determines the criteria for a Schengen visa. If you are a national of one of the nations on the list, you must have travel insurance that satisfies the criteria for a Schengen Passport.

5. Accidental Death

When talking about travel insurance, it can be difficult to bring up the subject of Accidental Death & Dismemberment (AD&D) coverage, even though it may be crucial for some passengers. Plans for accidental death and dismemberment are like life insurance in that you designate a beneficiary when you buy travel insurance. If you passed away or suffered a dismembering injury while traveling, that individual would be the one to receive the benefit.

6. Vacation Rental

For Americans renting a holiday home during their trip—including condos, cabins, villas, apartments, and more – vacation rental plans give property damage coverage. The insurance is designed to assist in defraying costs associated with potential accidental harm to the rental property, which may include broken electronics, windows, doors, and lighting fixtures. Bedding and linen stains may be covered by holiday rental damage insurance. These policies may also provide coverage for lost keys and key replacement expenses.

How to get the best travel insurance with InsureMyTrip

Before you start comparing travel insurance plans, determine what type of coverage you need. Consider factors such as your destination, length of travel, and any pre-existing medical conditions you may have. Use InsureMyTrip’s comparison tool to compare plans from different providers. Look for plans that offer the coverage you need at a price you can afford.

InsureMyTrip features customer reviews and ratings for each plan. Read through these reviews to get an idea of the experiences that other travelers have had with the plans you’re considering. Make sure that the plan you choose offers adequate coverage limits for the features you need, such as emergency medical coverage and trip cancellation.

Some plans may have a deductible that you must pay before the insurance coverage kicks in. Consider the deductible amount when comparing plans. Some travel insurance plans may offer additional features, such as coverage for adventure activities or rental car insurance. Consider these features if they are important to you.

Once you’ve found the travel insurance plan that meets your needs, purchase it through InsureMyTrip. Make sure to carefully review the policy documents and understand the coverage details. Remember to purchase your coverage well in advance of your trip to ensure that you are fully protected.

Final Words

InsureMyTrip is a comprehensive travel insurance comparison website that helps travelers find the best coverage options for their needs. By following the steps outlined above, travelers can ensure that they select the right plan for their trip, taking into account factors such as their destination, length of travel, and pre-existing medical conditions.